what is the income tax rate in dallas texas

Heres Teleports overview of personal corporate and other taxation topics in Dallas Texas. The Texas franchise tax is a privilege tax imposed on each taxable entity formed or organized in Texas or doing business in Texas.

Truth in Taxation Summary.

. Texas Income Tax Calculator 2021. It is the second-most populous county in Texas and the ninth-most. The state sales tax rate in Texas TX is currently 625.

Dallas Houston and San Antonio all have combined state and local sales tax rates of 825 for example. What is the sales tax on 100 in Texas. New employers should use the.

2021 Tax Year Rates. As of the 2010 census the population was 2368139. Dallas County collects on average 218 of a propertys assessed fair.

This is the total of state county and city sales tax rates. Your hourly wage or. Texas income tax rate and tax brackets shown in the table below are.

The minimum combined 2022 sales tax rate for Dallas Texas is 825. Texas income tax rate. Texas state income tax rate for 2022 is 0 because Texas does not collect a personal income tax.

Census Bureau Number of cities that have local income taxes. The Texas income tax has one tax bracket with a maximum marginal income tax of 000 as of 2022. Texas state income tax rate for 2022 is 0 because Texas does not collect a personal income tax.

If you make 55000 a year living in the region of Texas USA you will be taxed 9076. The Texas Franchise Tax. That means that your net pay will be 45925 per year or 3827 per month.

SNAP Food Stamps WIC Women Infants and Children TANF Temporary Assistance to Needy Families Health Care. Calculating Sales Tax For. Detailed Texas state income tax rates and brackets are available on this page.

Currently Texas unemployment insurance rates range from 031 to 631 with a taxable wage base of up to 9000 per employee per year. What is the local sales tax rate in Texas. Your average tax rate is.

100 rows Dallas County is a county located in the US. Annual income 25000 40000 80000 125000. Effective personal income tax rate.

If you make 70000 a year living in the region of Texas USA you will be taxed 8387. The Dallas sales tax rate is. How Your Texas Paycheck Works.

The Texas sales tax rate is currently 625. The median property tax in Dallas County Texas is 2827 per year for a home worth the median value of 129700. Texas has no individual income tax as of 2021 but it does levy a franchise tax of 0375 on some wholesalers and retail businesses.

Notice of Tax Rates Form 50-212 Tax Rate and Budget Information Tax Code 2618 For more information related to Dallas. Your average tax rate is 1198 and your marginal tax rate is 22.

Federal Support Keeps State Budgets Including Texas Healthy Amid Tumult From Covid 19 Induced Economic Ills Dallasfed Org

Margaret Hunt Hill Bridge Santiago Calatrava Santiago Calatrava Architecture Photography Santiago

Leading Accounting Outsourcing Firms In India Meru Accounting In 2022 Accounting Services Bookkeeping Services Bookkeeping

Houston Still An Energy Town Largely Pins Growth On The Sector Dallas Fed In 2022 Asset Management Energy Sector Oil And Gas Prices

Texas Income Tax Calculator Smartasset

Knowledge Is Power Let The Power Be In Your Hands And You Can Get Ahead Of The Game Screenshot This Review Certificate Programs Client Profile How To Become

Texas Income Tax Calculator Smartasset

91st Birthday For Him 91st Birthday Decoration 91st Birthday Etsy Birthday Poster Birthday For Him 80th Birthday

Weekly Allmanac For 4 3 14 Dallas Dallasrealestate Realestatemarket Real Estate Marketing Dallas Real Estate Dallas

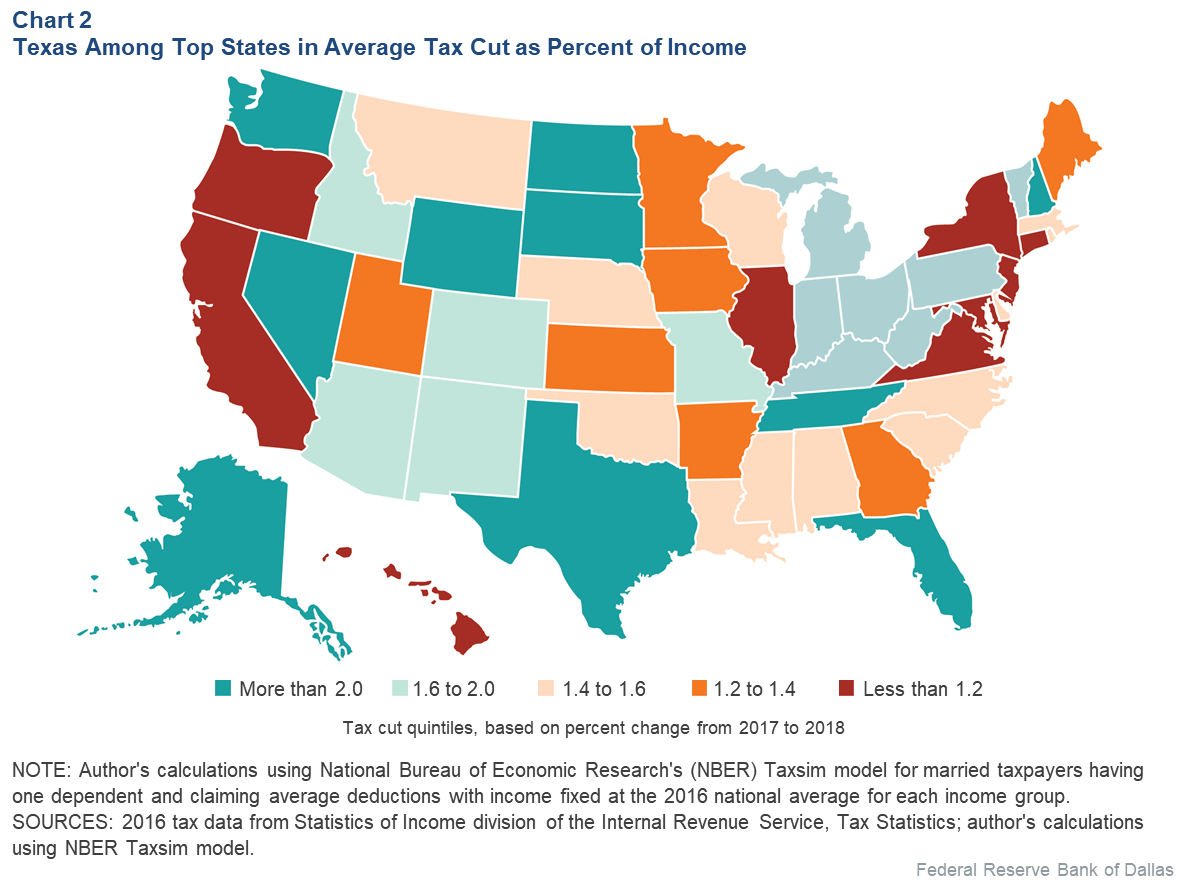

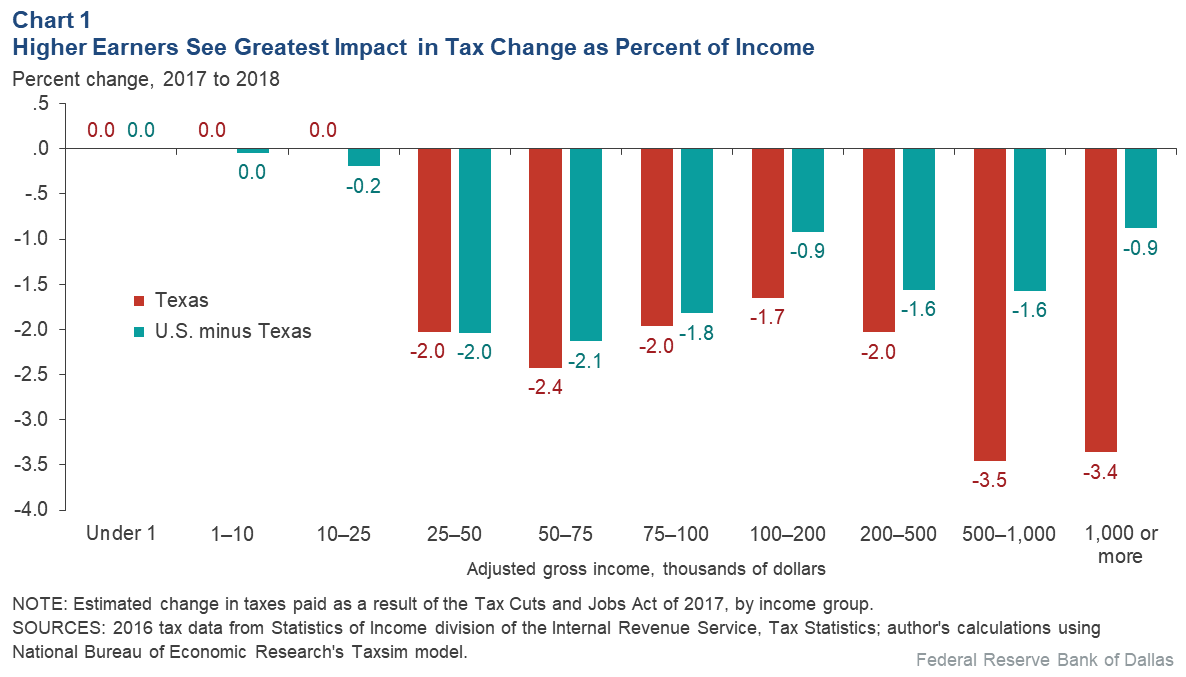

Texas Sees Job Output Gains From 2018 U S Tax Cut Dallasfed Org

Texas Sees Job Output Gains From 2018 U S Tax Cut Dallasfed Org

Cypress Texas Property Taxes What You Need To Know Property Tax Tax Attorney Tax Lawyer

Texas Income Tax Calculator Smartasset

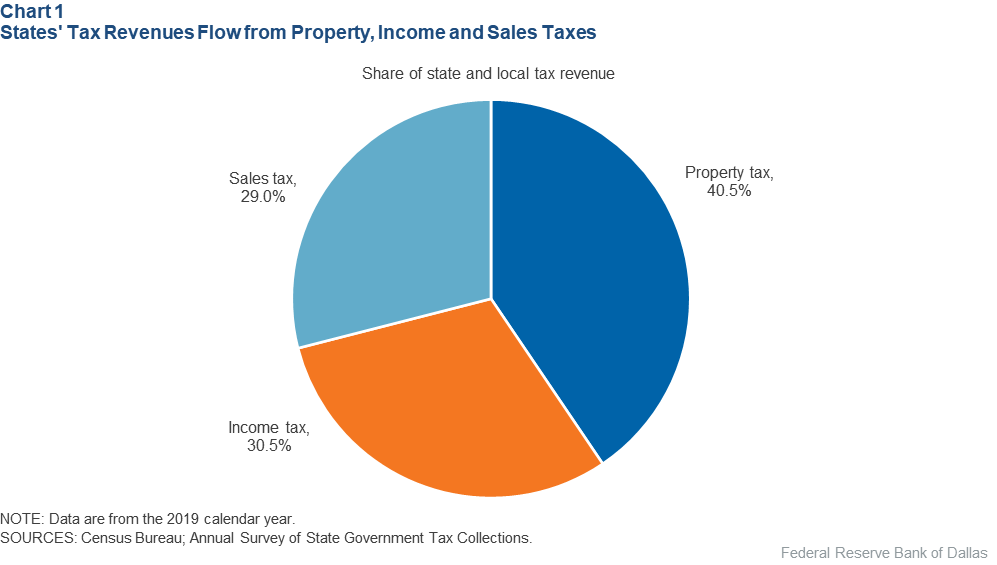

Covid 19 S Fiscal Ills Busted Texas Budgets Critical Local Choices Dallasfed Org

Here S How Much Money You Take Home From A 75 000 Salary

Tax Practitioners Perceptions Regarding Fraudulent Earned Income Tax Credit Claims A Descriptive Case Study To Investigate The Phenomenon Of Tax Practitioner Case Study Tax Credits Phenomena

Covid 19 S Fiscal Ills Busted Texas Budgets Critical Local Choices Dallasfed Org